Islamabad, June 10, 2025 — Pakistan’s Economic Survey for the fiscal year 2024–25 paints a nuanced picture: while macroeconomic indicators show marked improvement, sluggish growth and underperformance in key sectors intensify ongoing challenges.

Positive Indicators: Inflation & Stabilisation

- CPI Inflation dropped significantly from over 29% in 2023 to 4.6%, reaching a six-decade low.

- The fiscal deficit narrowed to ~5.5% of GDP, while the public debt-to-GDP ratio declined from 68% to 65%, aided by a PKR 1 trillion debt buyback.

- A current account surplus of US$1.9 billion was recorded from July–April, reversing last year’s US$200 million deficit.

- The central bank slashed rates by 1,100 bps, lowering the policy rate from 22% to 11%, easing credit pressure.

Growth Concerns: Agriculture & Industry Underperform

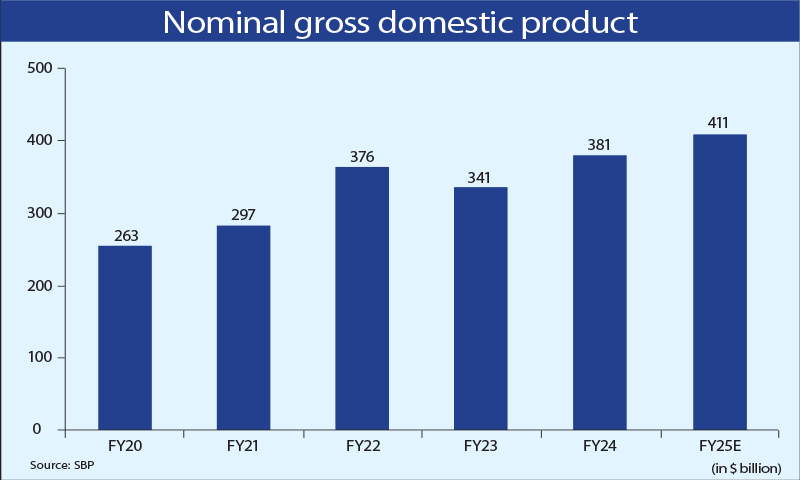

- GDP growth came in at 2.68%-2.7%, up from a contraction of -0.2% in 2023, but still short of the original 3.6% target.

- The agriculture sector grew by a mere 0.6%, hindered by a 13.5% slump in major crops — the weakest nine-year performance.

- Large-scale manufacturing shrank by 1.5%, while mining and quarrying contracted by 3.4%, though the industrial sector overall was a bright spot with a 4.8% rise.

- The services sector expanded by 2.9%, missing the 4.1% target, with notable underperformance in trade, transport, and finance.

Recovery Outlook: Reform-Driven Optimism

Finance Minister Aurangzeb described this as a “gradual recovery” — viewing the glass as both half-full and half-empty. He framed stabilization achievements in a global context, citing global GDP slowing to 2.8% vs Pakistan’s 2.7% growth.

The IMF acknowledged macro stability and budget alignment, though structural reforms remain a critical demand.

Looking ahead to FY26, the government aims for 4.2% GDP growth amid plans to widen the tax net, streamline subsidies, and launch a primary surplus — while defence spending is expected to rise 20%, potentially complicating fiscal priorities.

Expert Takes

- ADB forecasts PK growth of ~2.5% in FY25, contingent on successful implementation of reforms.

- Topline Securities projects inflation averaging 7–8% in 2025 — down from 13% in 2024 — but warns growth remains vulnerable to agriculture and industry performance

#EconomicSurvey #PES2025 #PakEconomy #InflationDrop #SlowGrowth #StructuralReforms #FiscalStability #IMFProgram