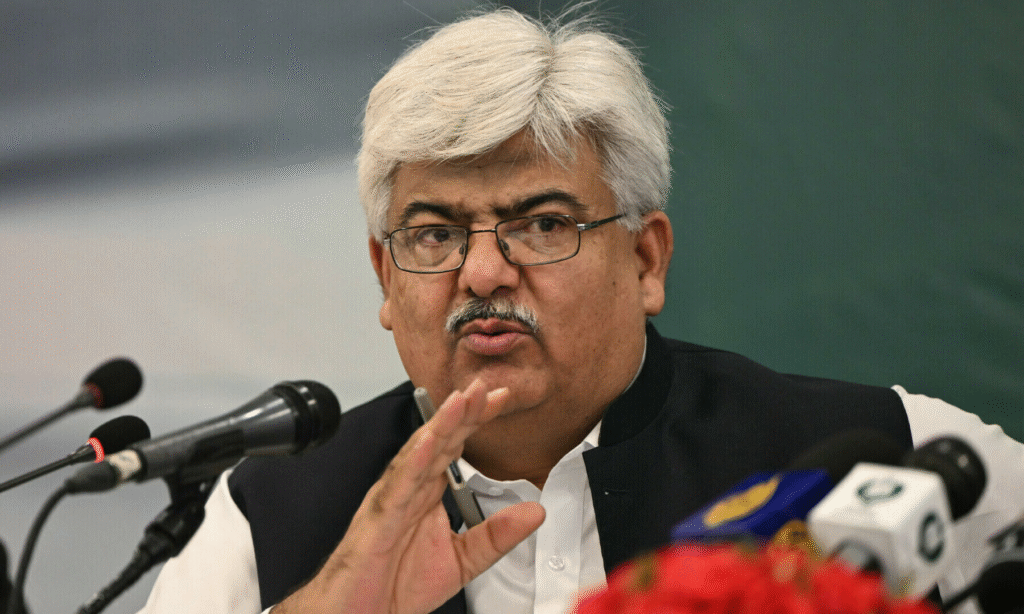

slamabad, June 12, 2025 – Pakistan’s Federal Board of Revenue (FBR), under Chairman Rashid Mahmood Langrial, has intensified efforts to plug revenue leakages by extending its enforcement actions from sugar into the tobacco sector—while rolling out a new flat 15% tax rate on passive income, as outlined in the 2025–26 Budget briefing.

Compliance Drive Expands from Sugar to Tobacco

Langrial revealed that the FBR’s crackdown on non-compliant sugar mills led to a 39% increase in revenues without raising tax rates. Now, a similar enforcement strategy is being applied to tobacco manufacturers. He reported early signs of better tax adherence in poultry and other segments, as the FBR collaborates with intelligence agencies to ensure full compliance .

15% Flat Tax Aims to Balance Passive Income

To address the tax disparity between passive and active income streams, the budget introduces a uniform 15% tax on passive income—including returns from bank deposits and investments—compared with the current 29% rate for active earnings. Langrial emphasised that this measure seeks to create parity and incentivise investment while simplifying the tax regime .

Digitalisation & Anti‑Corruption Measures

The FBR will tighten digital monitoring and data-driven enforcement across sectors. Langrial revealed that the Intelligence Bureau has been mobilised to oversee FBR staff, countering internal corruption and collusion. Likewise, poultry and construction segments have exhibited substantial tax evasion, now under scrutiny.

Impact and Outlook

- The sugar sector clampdown generated a 39% rise in revenues without rate hikes—signalling the potential strength of enforcement-led strategies .

- A flat 15% tax on passive income could level the playing field and reduce avoidance.

- Oversight from intelligence agencies aims to safeguard reform integrity.

- Expansion of compliance efforts into tobacco, poultry, and retail sectors suggests a broader fiscal-reset approach.

These enforcement and reform measures are integral to Pakistan’s broader goal of meeting IMF fiscal benchmarks, transitioning tax structures away from narrow reliance on rate increases to strategic monitoring, digitisation, and cross‑sectoral compliance.

#PakistanBudget2025 #FBRReform #TobaccoTax #PassiveIncomeTax #TaxCompliance #FiscalReform